r&d tax credit calculation uk

A Profitable SME RD Tax Credit Calculation Lets assume the following. This can be used to reduce your tax bill or increasing your taxable losses.

With over 12 years.

. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. Just follow the simple steps below. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC.

RD tax credits are calculated based on your RD spend. If there is any RDEC credit left over ie there were not enough profits or the company. Assuming your business fits these criteria you can check below for example calculations for RD tax credits.

The Research and Development Expenditure Credit RDEC scheme was introduced in the. To make an RD credit calculation you need to identify qualifying expenditure and enhance it by the relevant rate see below. If you qualify you can file an RD Tax Credits claim each yearThe benefit.

Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230 deduction. SME RD relief allows companies to. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

RDEC rate is assumed to be at 12 Step 1 Offset the RDEC credit against the companys tax liability. Corporation Tax prior to RD Tax Credits Claim. Contact GrantTree for help accessing innovation funding and RD tax relief.

Under the SME scheme you can only claim 65 of the qualifying spend. This can be done for the current financial. RD Tax Credit Calculator.

Select either an SME or Large. If the company spent 100000 on RD. The RD tax credit scheme is a UK government scheme that rewards innovation in the private sector.

When subtracting it from the original corporation tax before the claim the total saving for this RD tax credit calculation example would be 24700. If there is a 100000 payment to a subcontractor of which half is for RD activities the. The notional additional 130 RD tax deduction is deducted within the company tax computation.

54000 is the average claim value that RD tax credits can provide to innovating UK businesses. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. This information shown on this calculator should be interpreted as an indicative value range only.

Deduct the RD enhanced expenditure within the tax computation. Any information given should not be included within any documents. The rise in the rate of relief for SMEs means that the cash value of claims for tax paying companies is 26 for every 100 of RD spend from April 2015 based on a 20 tax rate and.

How much RD Tax Relief can your company claim. Our RD tax credit. The qualifying expenditure is 100000 thats already in accounts as expenditure.

Calculate your companys RD tax credit claim The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. This guidance is designed to help you make a claim for tax relief if you are an SME. For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect.

100000 X 130 Enhanced rate 130000. Company X made profits of 400000 for the year calculate the RD tax credit saving.

A Starter S Guide To R D Tax Credits

How Do You Calculate R D Expenses Source Advisors

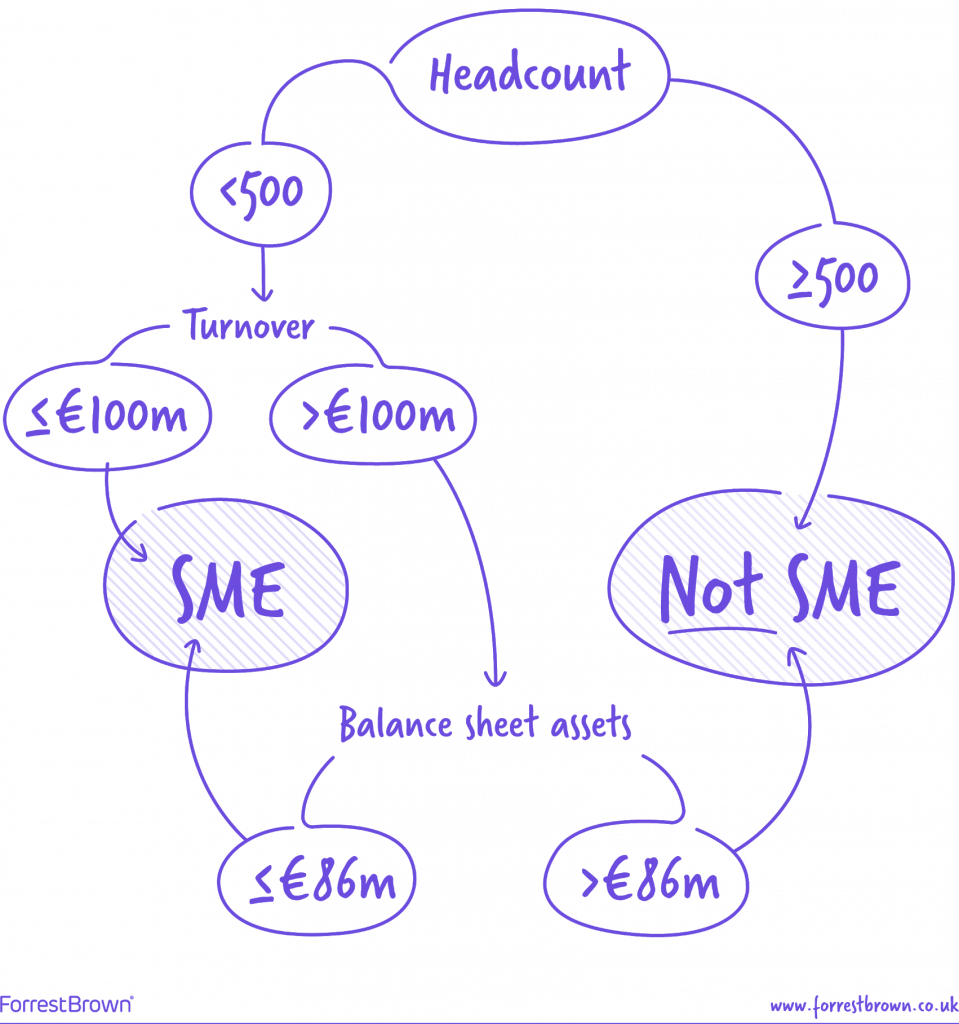

What Is An Sme For R D Tax Credit Purposes Forrestbrown

R D Tax Credit Calculation Examples Mpa

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

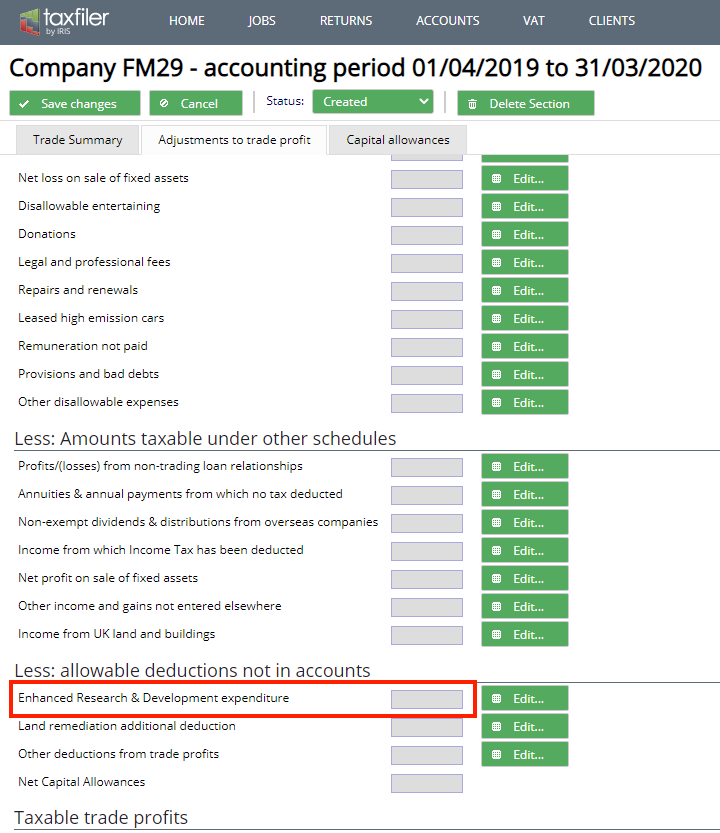

Research And Development Or Film Relief And Tax Credits Support Taxfiler

How To Enter Research And Development Claims

Freed Maxick Guide To The Federal Research And Development Tax Credit Freed Maxick

How To Calculate R D Tax Relief For Smes

%20(2).gif)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

Research Development Tax Relief What Is It How To Claim It

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

Rdvault The Best R D Tax Credit Software Guided By A Team Of Experts

What S The R D Tax Credit Program Overview Cti

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible